Guide

Pre-Founder 101

Intro to Pre-Founder

Maybe grabbing the re-directs of Pre-Founder by every means might be overly ambitious. But, considering that this is intellectually the only way I can wrap my head around how to push innovation further into the use of talented and smart individuals within the global workforce - this might not be.

What is “pre-founder”?

Pre-founder or PreFounder, depending on however the Pre-/Preseed debate pans out, has been commonly defined as the stage before pre-seed. But to me:

Pre-Founder is a type of venture investment into a current operator for founder potential foreseen by the investor and acknowledged by the operator themselves.

Who is a Pre-Founder?

Pre-Founders can be determined in the following positions:

Venture Studio. The scouted, and then hired, CEO.

Incubators. Specifically the ones that decide to not continue with their entered idea.

In-house Recruiting. Candidates brought together for a specific role. Haven’t left their current job, but were open enough to take the call.

Zeal-type of recruits. Outsourced equity for

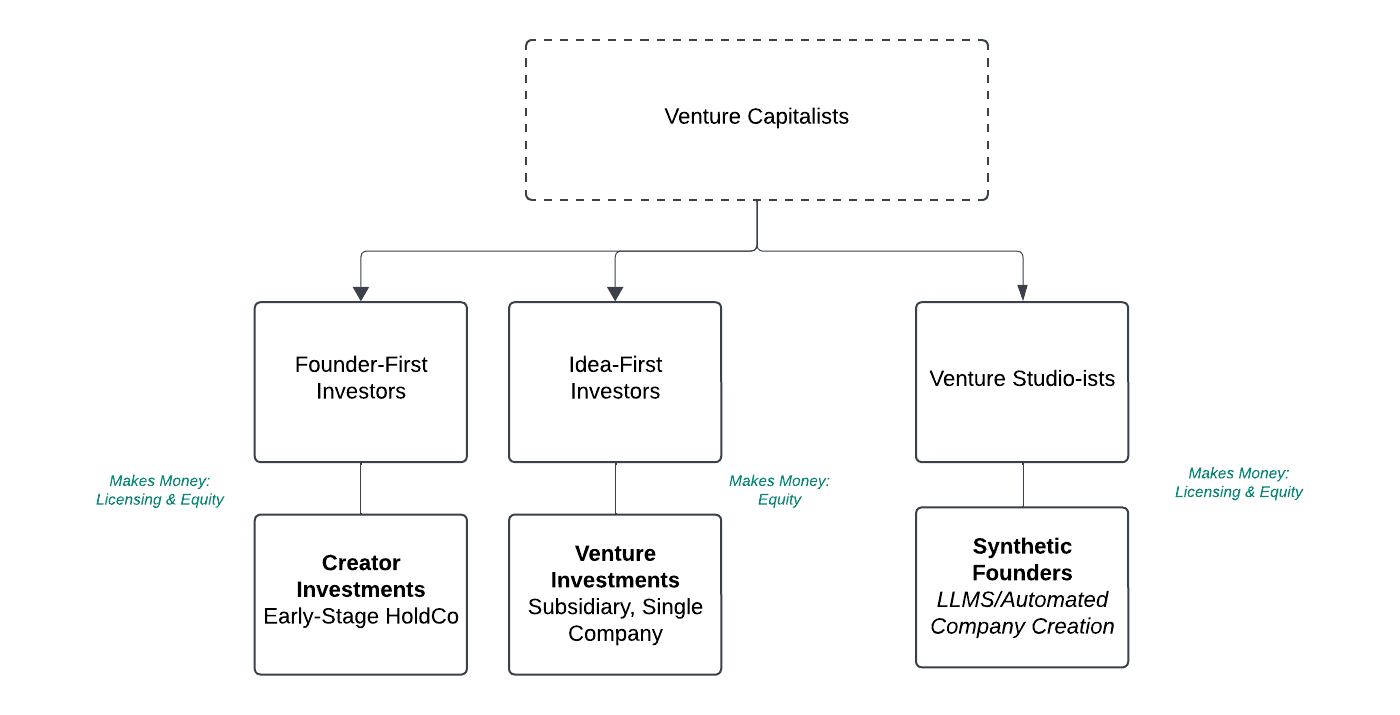

Who sees Pre-Founder?

The Pre-Founder track can be found in many Founder-adjacent roles to the investor.

Pre-Founder can be found by both:

The Investor. Meeting with very early founders.

Head of Talent. Recruiting for portfolio companies.An early-stage holding company for individuals is an emerging business model where a single person or small team establishes a holding company to manage multiple business ventures, investments, or intellectual property under one umbrella. Unlike traditional holding companies that focus on conglomerates or large corporations, this model is tailored for entrepreneurs who want to diversify their activities and assets while maintaining centralized control and flexibility. For individual entrepreneurs, early-stage holding companies offer a way to manage multiple streams of income, leverage synergies between businesses, and position themselves for long-term financial success.

What Is an Early-Stage Holding Company for Individuals?

An early-stage holding company for individuals is an entity that owns and manages various business ventures or assets controlled by a single entrepreneur or a small group of co-founders. Instead of focusing on building just one company, the individual entrepreneur leverages a holding company to manage several business initiatives, investments, and intellectual property.

These ventures can include:

Startups across different sectors.

Real estate investments.

Licensing deals or royalties from intellectual property.

Joint ventures or equity stakes in other companies.

Consulting or freelance businesses.

Creative projects, such as content creation or media ventures.

This model allows individuals to create a diversified business portfolio while maintaining ownership and control across all ventures.

Why Create an Early-Stage Holding Company as an Individual?

Entrepreneurs may choose to create an early-stage holding company for several reasons:

1. Diversification of Business Ventures

For many entrepreneurs, focusing on a single business can be risky. If that venture fails, all of their time, effort, and financial resources are lost. Early-stage holding companies enable individuals to diversify their efforts across multiple business ventures, reducing the risk of relying on just one source of income or success. If one business underperforms, others in the portfolio may still thrive, providing a safety net and more predictable cash flow.

2. Centralized Control and Flexibility

By operating under a holding company, individual entrepreneurs maintain centralized control over multiple businesses. This structure allows for more flexibility when launching new ventures or pivoting existing ones. Entrepreneurs can quickly shift resources, capital, or attention from one business to another depending on market trends or personal goals. This model gives entrepreneurs the agility needed to take advantage of new opportunities as they arise, without having to start from scratch each time.

3. Maximizing Synergies Between Ventures

Operating multiple businesses under a holding company allows entrepreneurs to take advantage of synergies between those ventures. For example, an individual may run a marketing agency while simultaneously owning an e-commerce brand. The e-commerce business can benefit from the marketing agency’s services at a lower cost, while the marketing agency gains practical experience to showcase to other clients. These types of cross-business benefits can enhance efficiency and drive growth across the portfolio.

4. Optimized Tax Strategy

Holding companies can also offer tax advantages. Entrepreneurs who run multiple ventures under one entity may have more flexibility in how profits are distributed and taxed. For instance, profits from one subsidiary can be used to invest in another business without incurring immediate tax liabilities. Additionally, expenses across the holding company, such as legal or operational costs, can be shared across ventures, reducing the overall tax burden.

It’s important to consult a tax advisor or financial professional to understand the specific tax advantages and obligations based on local tax laws and the structure of the holding company.

5. Ease of Raising Capital

An early-stage holding company structure can make it easier for entrepreneurs to raise capital, especially when they have multiple ventures under their umbrella. Instead of raising money for a single company, the entrepreneur can position the holding company as a diversified investment vehicle, offering potential investors exposure to a range of businesses. This diversification may attract investors who want to spread their risk across multiple assets or industries. Additionally, it provides the flexibility to allocate investor capital where it’s needed most across the portfolio.

6. Asset Protection

Establishing a holding company for an individual’s ventures can offer an extra layer of protection for their personal assets. By separating ownership of individual companies under a holding structure, the entrepreneur can insulate themselves from liabilities that may arise from any one business. If one company faces legal or financial trouble, the assets and operations of the other subsidiaries remain protected, reducing the overall risk to the entrepreneur.

7. Simplified Exit Strategy

An early-stage holding company allows for a more strategic approach to exiting one or more businesses. The holding company structure makes it easier to sell, spin off, or wind down individual ventures without disrupting the overall business portfolio. For instance, if one of the ventures becomes highly successful, the entrepreneur can sell that business without dissolving the entire holding company. Conversely, if a business is underperforming, it can be closed down or sold off without affecting the other entities within the holding company.

Setting Up an Early-Stage Holding Company for Individuals

Setting up an early-stage holding company involves several key steps:

1. Choose the Appropriate Business Structure

The first step is to decide on the legal structure of the holding company. The most common types are:

Limited Liability Company (LLC): LLCs are flexible and easy to set up, offering protection of personal assets while allowing pass-through taxation. LLCs are popular for holding companies because they offer a straightforward structure for managing multiple entities.

C-Corporation: A C-Corp may be more appropriate if the entrepreneur plans to raise venture capital or take the holding company public. This structure offers more flexibility for issuing shares and raising capital but comes with the disadvantage of double taxation (corporate and individual).

S-Corporation: Similar to a C-Corp but with pass-through taxation, an S-Corp can also be a good choice for small to mid-sized businesses. However, it has more restrictions on the number of shareholders and who can own shares.

Each structure comes with its own legal and tax implications, so it's essential to consult legal and tax professionals when deciding which to choose.

2. Define the Scope of the Holding Company

Once the legal structure is established, it’s important to clearly define the scope of the holding company and its subsidiaries. Entrepreneurs should determine:

What businesses, assets, or intellectual property the holding company will own.

The operating structure of each business, including whether they will be run as independent subsidiaries or more closely integrated.

The strategy for capital allocation and profit-sharing between the holding company and its subsidiaries.

3. Create Governance and Management Structures

Although an individual or small team typically owns and controls an early-stage holding company, it’s crucial to create clear governance structures. This includes deciding how decisions are made across the portfolio, how resources are allocated, and what the process is for launching new ventures or winding down underperforming ones. Having a governance plan helps ensure smooth operations as the holding company grows and adds more businesses to its portfolio.

4. Establish Financial and Operational Systems

As a holding company grows, it’s important to put in place financial and operational systems that can manage the complexities of multiple ventures. This includes setting up accounting systems to track performance across each entity, implementing payroll systems if there are employees, and creating operational frameworks to maximize efficiency across the portfolio. Shared services such as marketing, finance, and legal can be centralized to reduce overhead and drive cost savings.

Conclusion: Why Early-Stage Holding Companies for Individuals are a Powerful Model

For individual entrepreneurs, early-stage holding companies provide a way to diversify income streams, centralize control, and leverage synergies across multiple ventures. This model allows for more flexibility than traditional business structures and offers a range of benefits, including risk reduction, tax optimization, and asset protection. With the right planning and execution, early-stage holding companies can be a powerful tool for individuals looking to manage and grow their business empires while maintaining long-term financial stability.